Making ends meet: How raising minimum wage would impact Gen Z

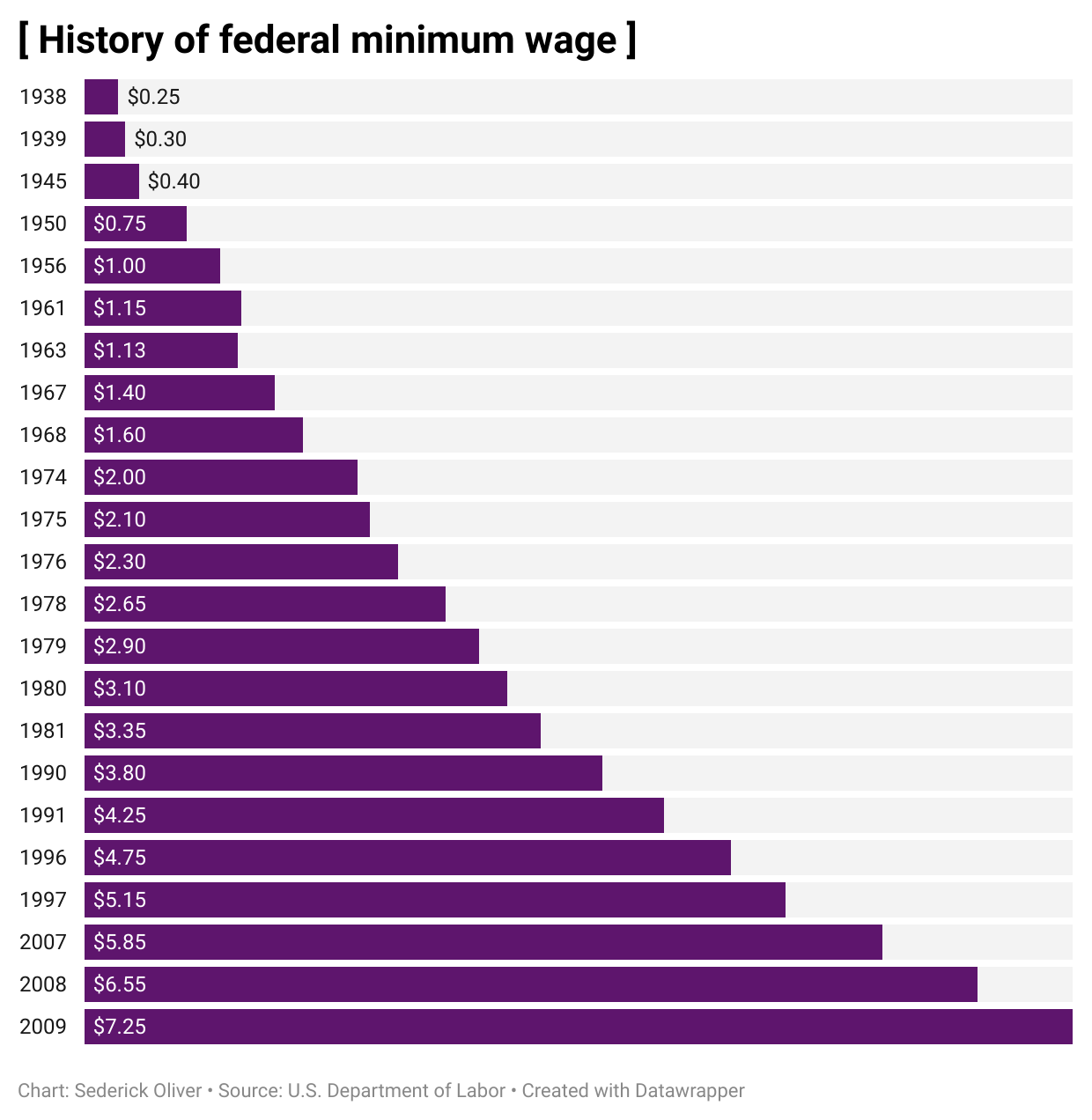

Created by Congress under the Fair Labor Standards Act in 1938, minimum wage was set at $0.25 per hour.

The amount has gradually increased to the current rate of $7.25. This figure hasn’t changed since July 2009, the longest period without any activity from the U.S. Department of Labor.

But this was prior to the proposal of the Raise the Wage Act of 2021. If enacted, the Raise the Wage Act would raise the federal minimum wage in annual increments to $15 per hour by June 2025.

This would result in $121 billion in higher wages for 39.7 million low-wage workers, benefitting their families and communities, according to the Economic Policy Institute.

"The vast majority of employees who would benefit are adults — disproportionately women — in working families, who work at least 20 hours a week and depend on their earnings to make ends meet," according to the Economic Policy Institute.

Living wage

Today, workers who earn the federal minimum wage of $7.25 an hour make about 29% less per hour than their counterparts made 50 years ago (after adjusting for inflation). But workers produce more today from each hour of work, with productivity nearly doubling since the late 1960s, according to the Economic Policy Institute.

Th Raise the Wage Act would directly raise the wages of 28.1 million workers by 2024.

Another 11.6 million workers whose wages are just above the new minimum would likely see a wage increase through “spillover” effects, according to the Economic Policy Institute.

After quitting his minimum wage-earning job at Family Dollar, Tederro Hewitt, 20, now works at an Amazon workhouse at an increased salary. The differences between the two are “night and day,” he said.

As a cashier at Family Dollar, Hewitt earned about $400 each pay period while working around 30 hours per week.

The job lacked flexibility as employees were scarce and often had to compensate a heavy workload. The majority of Hewitt’s paychecks went toward maintenance on his car and to his high school senior year activity package that included prom and graduation expenses.

After his senior year at Kathlyn Joy Gilliam Collegiate Academy in Dallas, Texas, Hewitt enrolled at Texas Southern University and needed a higher paying job.

He started working in the warehouse at an Amazon Fulfillment Center in Dallas during the summer of 2020 before his sophomore year of college.

Hewitt packs and sorts out customer orders for shipment. The environment is fast-paced. The work is tiring. But Hewitt enjoys it.

His hours increased to 40 hours per week and his paychecks are now around $1,200, granting him a financial liberty that he thought was previously unattainable.

“Honestly, it was so vastly different. Being able to have extra money after handling my priorities was a great feeling,” said Hewitt.

Hewitt was even able to help his grandmother, with whom he stays, pay certain expenses such as their cable and electric bills.

Living wage is classified as the hourly amount an individual in a household must earn to support them and their family. As an adult without any children in Texas, living wage qualifies as earning $16.65 and above, per the Living Wage Calculation for Texas.

“Everything is much more flexible and conducive to you. When you’re working a minimum wage job, it feels as if you don’t have any rights or freedom because everything kind of falls on you,” Hewitt said.

He said changing jobs has also helped him do better in school because he spends less time worrying about money.

“Last year, I wasn’t able to save anything for the school year because I didn’t make much and I had other things to use the money for. I think that kind of messed up my freshman year because I couldn’t enjoy certain things. Now things are different, and that situation doesn’t live rent free in my head anymore,” said Hewitt.

Photo courtesy of Tederro Hewitt

Photo courtesy of Tederro Hewitt

Photo courtesy of Tederro Hewitt

Photo courtesy of Tederro Hewitt

Lavada Graham, mother, works at the Omni Dallas Hotel in Dallas, Texas. She serves as an assistant front office manager, helping monitor the front desk operation which includes guest registration, room assignment and check-out procedures.

The living wage for households in Texas for families with one adult and three children is $51.64. Graham makes much less than this.

“I try my hardest to support all of my three kids, I’ll give them the world if I could,” Lavada said as she references her three children Kevion, Tre’vion and Jakeria.

Her oldest child, Kevion is a junior criminal justice major at TCU. He said he believes his experiences growing up have shaped his ambitious attitude and furthered his pursuit of excellence.

Making ends meet

Households in Texas have a median income of $60,629, which is slightly less than the income of homes across the United States. 13.6% of Texas’ population lived below the poverty line in 2019. Data showed lower income homes were likely to spend more to make ends meet.

Noah Kersey, 17, works 30 to 35 hours a week as a crew member at a McDonald’s in Dallas to earn money to help his family — his mom and two younger brothers.

“I’m not able to help my moms like I really want to... We aren’t even middle class, we’re really lower middle class and making minimum wage isn’t helping at all,” Kersey said.

His mother’s paycheck as a postal worker doesn’t stretch far enough.

She earns less than $45,000 a year which classifies them as a lower middle-class household. She reluctantly accepts any monetary compensation that Kersey is able to provide.

“I tell him that he doesn’t have to pay for anything but since he insists, I allow him to pay the cheapest bill which is the electricity,” Wanda said.

Noah Kersey makes about $300 per pay period. He uses the money to pay for his cellphone bill, his clothes, shoes and entertainment. It also goes to pay his family’s electric bill.

“I understand that she doesn’t want me to help, but I feel as the oldest that it is mandatory that I do help and bring something to the table,” Noah said.

Noah quit the football team because he was exhausted from balancing work and school.

“I’ll find time to play in the future, but right now this [my family] is my obligation. I love the game, but I love my family more,” Kersey said.

In Texas, 38% of working families earn less than $47,000 per year for a family of four, according to the Center for Public Policy Priorities.

Kersey's family falls within the 38%.

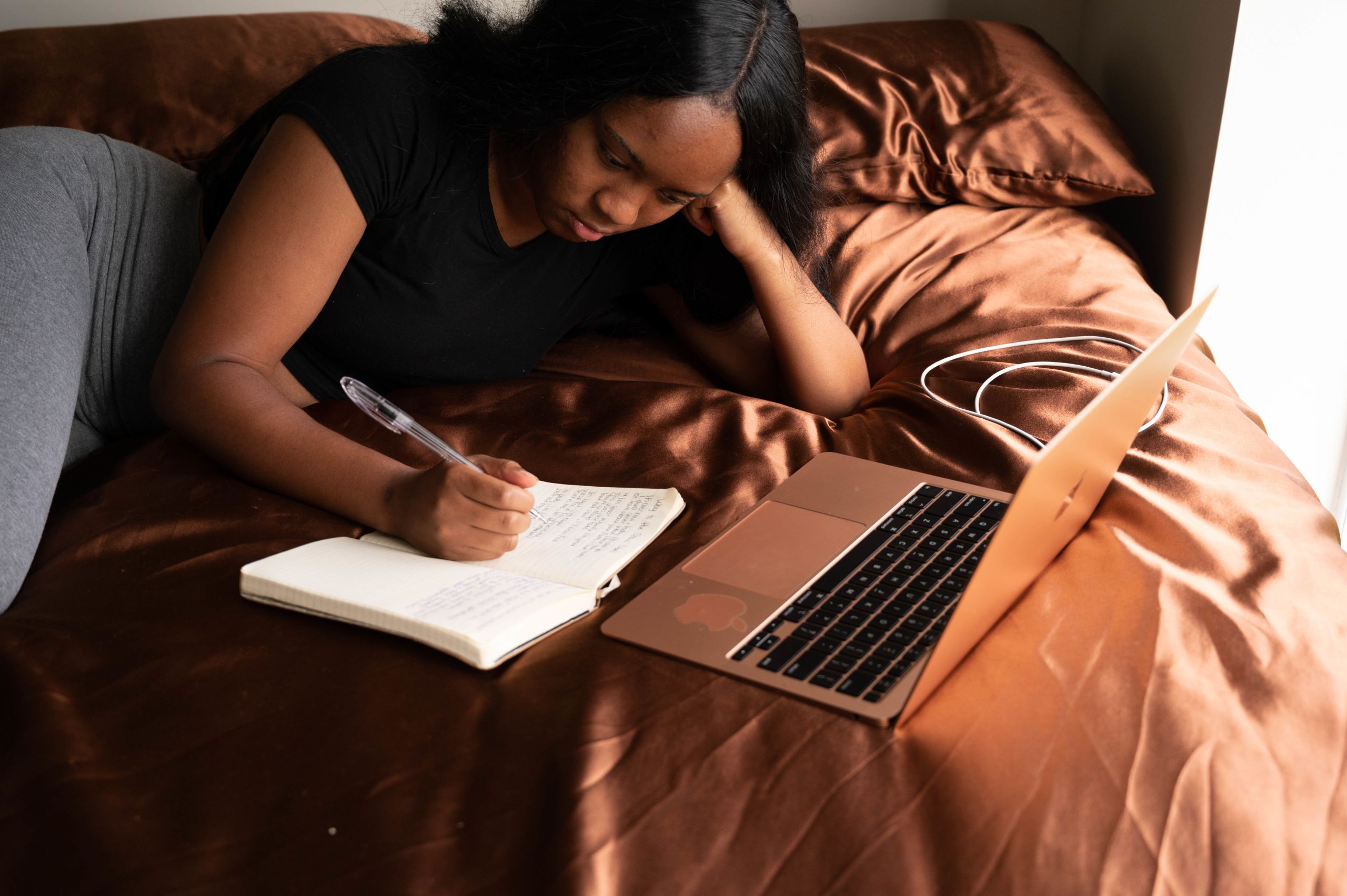

Another household that falls within that 38 percent is the family of TCU junior psychology major Tasia Massinburg.

Instead of becoming dependent on her parents for money, she obtained a minimum wage-earning job on campus in the Mary Couts Burnett Library. She got the job to pay for lab materials, groceries, textbooks and any car-related expenses.

“My family isn’t rich, so I figured instead of asking them for help, I’ll go out and get it myself,” said Massinburg.

Her mother, Latasha Harris, cites their family's financial situation as the reason for Tasia’s ambitious attitude.

“Tasia’s so caring and selfless that she actually believes that not asking us for help is the right thing to do. I understand we may not be rich, but we’re still here to help in any possible way," Harris said.

Tasia has worked for the library since the second semester of her first year. Her paychecks are around $200 biweekly.

Massinburg has learned how to ration a $200 budget for two weeks. She said the key to her conservative attitude is buying what she needs and not what she wants.

A cheerleader all throughout her time at Desoto High school, Massinburg has postponed her dream of cheering for TCU.

“Between classes and working, I barely have any time for myself. I love cheering and still hope to ultimately make the squad, but school and work is more important as of right now,” Massinburg said.

20 states — not including Texas — increased their minimum wages on January 1, 2021. If the Raise the Wage Act of 2021 is passed, it will help boost the income of low-wage workers who keep their jobs. A higher minimum wage will raise low-wage working families’ real income and lift some of those families out of poverty, according to the Congressional Budget Office.

Photo courtesy of Tasia Massinburg

Photo courtesy of Tasia Massinburg

Photo courtesy of Tasia Massinburg

Photo courtesy of Tasia Massinburg

Women in poverty

The poverty numbers between women and men are about equal until the ages of 18 and 24. The statistics for women increase to alarmingly high rates when they finish high school and are tasked with starting a life and career.

Women are more likely to be in poverty than men, according to Data USA. The U.S. Census Bureau data reported that of the 38.1 million people living in poverty in 2018, 56% of that figure, or roughly about 21.4 million, were women.

For JaLynn Brown, 29, financial freedom was especially difficult to find since she gave birth at the age of 21. After graduating from Trinity Academy, Brown proceeded to attend Prairie View A&M University but left upon having her child, and it became more difficult to find a job.

“It was really hard to find a good-paying job with so much going on, making sure that my daughter was always accounted for,” said Brown.

“I probably should’ve finished college and I guess I still could… but I just felt compelled to find work that’ll allow me to take care of my child,” Brown said.

But, choosing to follow her entrepreneurial dreams, Brown has started a clothing company called One of a Kind.

Women between the ages of 25 to 34 make up the largest demographic living in poverty. In Texas, the average male salary is $68,763 as opposed to the $50,216 earned by women.

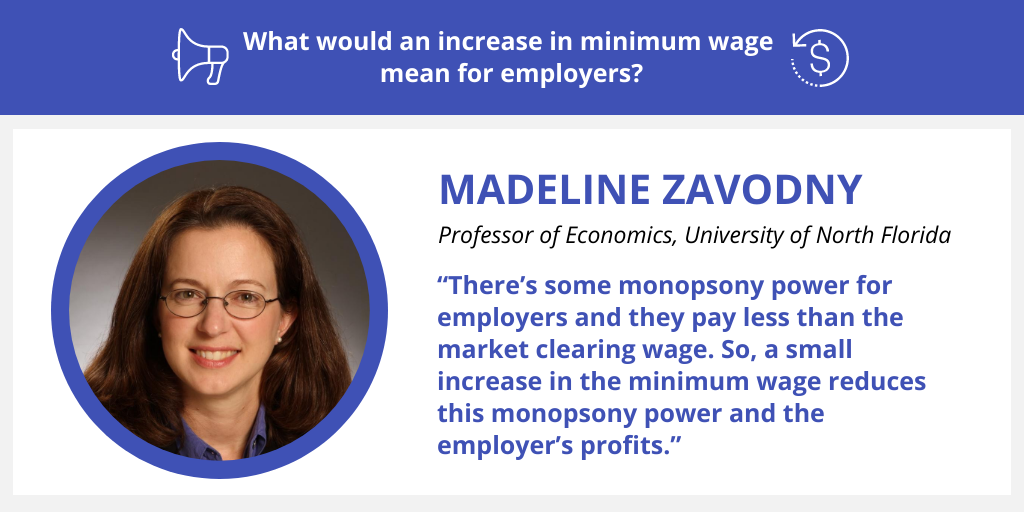

University of North Florida Economics Professor Madeline Zavodny cited maternal responsibilities and lower-earning majors as reasons for the discrepancy in salaries between men and women.

“For college graduates there’s a difference in majors, women tend to pick lower paying majors. Even when you look within majors, you take two bio or communication majors… it’s really when people start having kids when the differences start,” Zavodny said.

This perspective remains consistent with the research that shows the average age a woman has her first child in the U.S. was 26.9 in 2018. That figure fits well within the 25 to 34 range that represents the highest demographic living in poverty.

Photo courtesy of Madeline Zavodny

Photo courtesy of Madeline Zavodny

Photo courtesy of JaLynn Brown

Photo courtesy of JaLynn Brown

Photo courtesy of JaLynn Brown

Photo courtesy of JaLynn Brown

Employer's perspective

Increasing minimum wage from $7.25 to $15 would have many budgetary effects. Depending on a company's finances, increasing minimum wage would cause many changes for employers and the landscape of their businesses.

The potential downside of the increase is that a higher minimum wage may discourage certain businesses from hiring the low-wage, low-skill workers that are intended to fulfill minimum wage positions, according to David Neumark, distinguished professor of economics and co-director of the Center for Population, Inequality and Policy at the University of California, Irving.

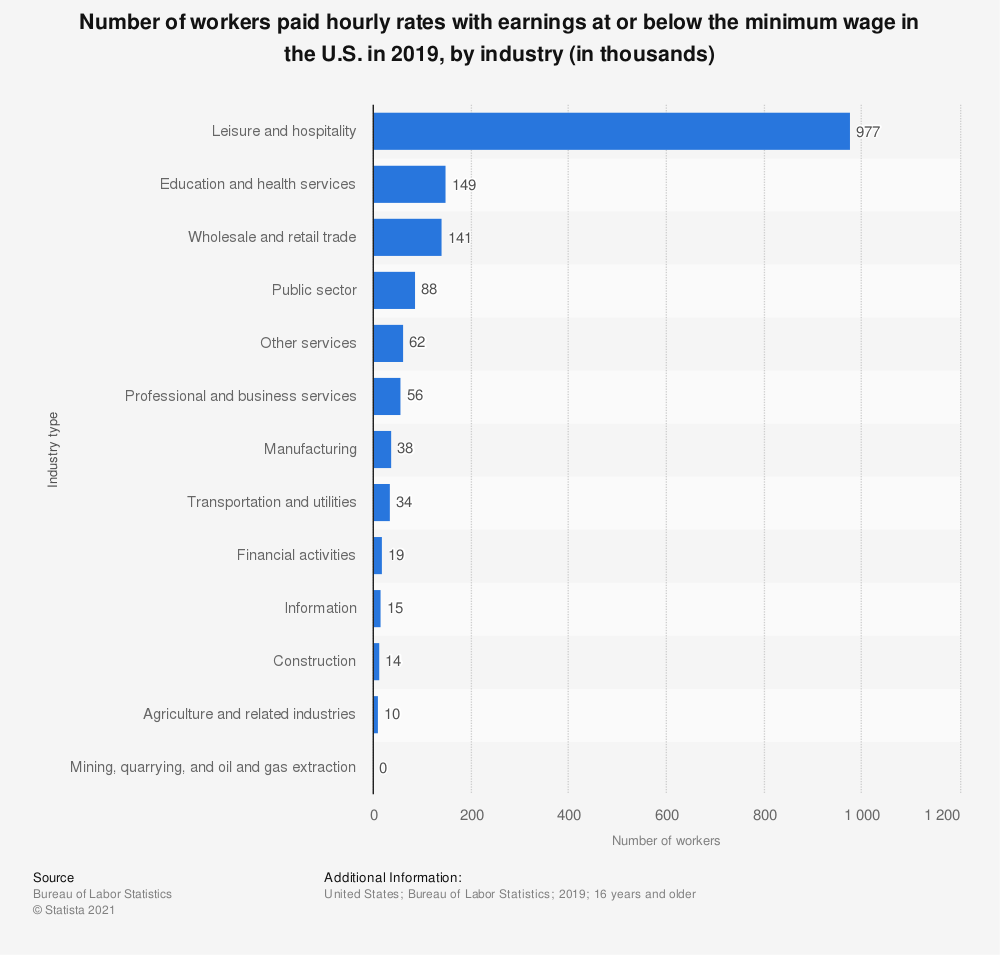

Teenage hourly employees from ages 16 and 19 represented about 10% of those earning the minimum wage or less. If you expand the demographic to 16 to 24, workers comprised almost half - about 45% - of the 2.6 million hourly workers earning at or below the federal minimum.

In response to the wage increase, it is possible companies would look to hire older, more skilled employees with a smaller margin of error. Younger employees would have a harder time finding jobs, with their lack of credentials and experience working against them. The acclimation process for the trainee would accelerate because the increased base pay would eliminate the room for mistakes.

“If you have to pay so little for your industry to survive then your industry should not survive,” John Harvey, a TCU professor of economics said. “We shouldn’t have industries that depend on paying people way less than living wage.”

Photo courtesy of John Harvey

Photo courtesy of John Harvey

Data from Bureau of Labor Statistics

Data from Bureau of Labor Statistics

This story is one in a series about how Generation Z functions, interacts and incites change in today's world.

Read the next story to explore more about Gen Z in the working world and how social media has impacted the workplace.